Israel’s national budget for 2024 indicates a “day after” with more warfare, less welfare and less equity.

The revised national budget for the present year (2024) just tabled in the Knesset by the Cabinet for approval reflects, to a large degree, the same strategic problem that has bedeviled the military campaign since the beginning of the ground invasion in Gaza – the absence of a credible plan for “the day after.”

The revised 2024 budget is characterized mainly by a huge increase in the defense budget, an increase far larger than anything we have seen in the past. And this is to be voted upon without any presentation to the general public or to the Knesset itself of a specific plan, or alternative plans, vis-à-vis what is to happen when the fighting ends. Does the present government anticipate years and years of war against the Hamas? Has it lost all belief in the possibility of a political solution? And worse yet – has the incumbent government abandoned the very possibility of a political solution, preferring instead ongoing hostilities with Palestinians? In the absence of political goals it is difficult, nay impossible, to calculate costs and construct a budget based on what it is that Israel is aiming for. The option of continued fighting until the Hamas is disbanded requires an immense investment, in order to maintain a large armed force for many years to come, while the option of fighting only until the Americans say “Stop!” – as was the case in previous rounds of fighting – requires a smaller sum.

In the absence of clear goals and in light of the fact that Israel’s generals are asking for more and more time to achieve their military ends, what we have is a budget predicated on a prolonged war and by military actions guided by the notion that what has failed to be achieved by force will be achieved with greater force.

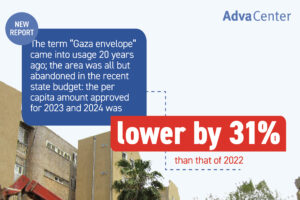

The absence of a program for “the day after” will have an adverse effect on Israel’s social services, including education, health, welfare and higher education. This, due to the fact that, among others, a greatly enlarged defense budget will come at the expense of reduced social services, for which there is no credible plan either. Will the state provide full financing for the formidable project of returning displaced persons to homes in located in the Gaza envelope or adjacent to the Lebanon border? Will the state provide full financing to repair the vast infrastructure damage? Or will it supply some sort of basic compensation and then leave the rest to the “free market.” The latter may result in reducing thousands of households to a level of income below the poverty line. These questions are especially significant in light of the fact that for years now, Israel’s social services have been suffering from a lack of personnel, including teachers, nurses and social workers, due to the low salaries paid in the public sector.

Moreover, the social services budget is completely devoid of vision or soul. The budget and accompanying documents contain no statement about the social services whatsoever – nothing about reviving public education, nothing about broadening higher education or reinforcing the public health system, nothing about increasing investments in localities in which Arab citizens of Israel reside, rather than decreasing them, the latter of which is one of the salient features of the new budget. Soldiers fighting in the various arenas of the present war will be demobilized into a society much less caring than what is implied by the popular war slogan, “We are all together in this.”

There remains a crucial issue: where will the financing come from for a much larger defense allotment as well as for the tasks ahead: rebuilding the settlements in the Gaza envelope as well as those near the Lebanese border, and reinforcing the social services?

Now, the main source of state revenue is taxation. Taxes are of two kinds: direct taxes (the major one of which is income tax) and indirect taxes (the major one of which is VAT). Together, the two examples constitute half of state revenues from taxation. As is well-known, income tax is more equitable, as low-income persons are either exempt or pay a lower percentage of their earnings, while higher income persons pay a larger percent of their earnings, while VAT is less equitable, as all individuals pay the same tax on purchases, and as such, low-income individuals pay a higher percentage of their income. In recent years, state revenues from VAT have been greater than revenues from income tax. The present government’s budgetary decision to raise VAT rather than income tax levels is evidence of the continuation of a less equitable approach to financing the war.

Israel’s national budget for 2024 indicates a “day after” with more warfare, less welfare and less equity.

// This op-ed was published in Hebrew in the newspaper Maariv